Account Trading

Brokerage accounts come in three different forms: cash accounts, margin accounts, and discretionary accounts. cash accounts -this is the most basic type of brokerage account. Open trading account online with hdfc securities we provide you hassle free online trading with our multiple trading platforms such as mobile app, proterminal, mpowered or visit our nearest branch. trade now!. A mam account does something similar, but allows the fund manager to manage multiple trading accounts. micro trading accounts. micro trading refers to lower transaction trades in cfds and currencies. they are a good way to begin trading in forex and for experienced traders who don’t have much time to devote to transactions. account trading Brokerage account put your money to work in our easy-to-manage account enjoy $0 commissions for online us-listed stock, etf, and options trades. 1 get easy access to your cash with a free debit card, checking, or bill pay. 2.

Fidelity Brokerage Account From Fidelity Investments

Wellstrade complements a account trading wells fargo bank account, and the broker incentivizes you to link your accounts by offering a reduced trading commission of $2. 95. read more…. Online trading of brokerage products--stocks, etfs, cds, and bonds--is simple in a vanguard brokerage account.

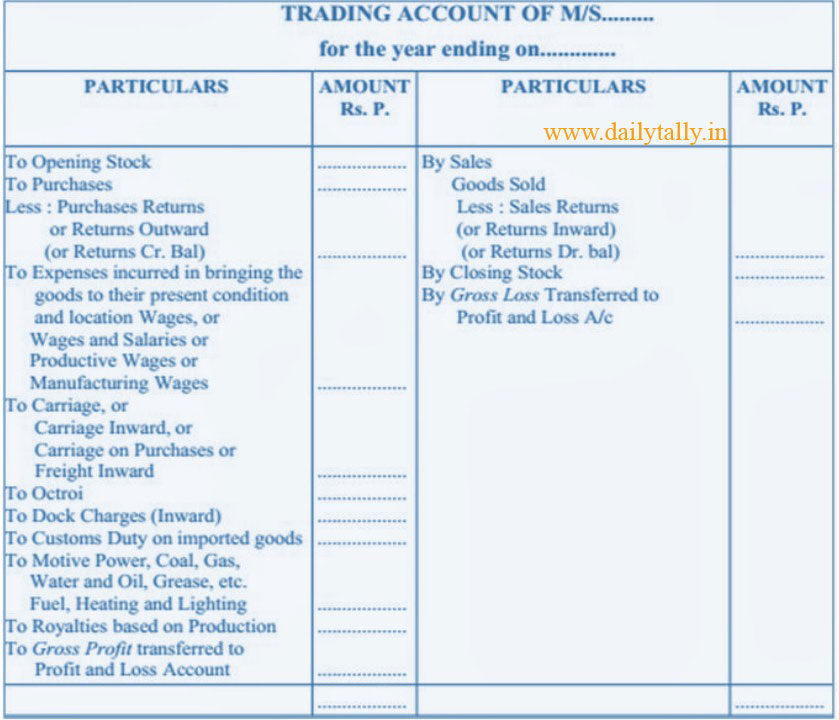

A brokerage account is a taxable investment account used to buy stocks, bonds, mutual funds and other investments. most brokers allow investors to open a brokerage account online in a few quick steps. Trading account. during the period-end closing process of a company, all the financial statements are prepared and finalized. trading account is the account trading first step in the process of preparing the final accounts of a company. as the name suggests it includes all the trading activities conducted by a business to ascertain the gross profit/loss.. trading account is a nominal account in nature.

Open A Forex Trading Account Open An Fx Account Forex Com

Open a forex trading account. open an account and start trading in three simple steps. tell us about yourself fund your account start trading get started. or, try a demo account. get started or, try a demo account. our promise to you. we'll deliver quality and value. Trading account: a trading account is similar to a traditional bank account, holding cash and securities, and is administered by an investment dealer. the account is held at a financial. A brokerage account allows you to buy and sell investments, such as stocks, bonds, exchange traded funds (etfs), and mutual funds. this account type can also be referred to as a taxable investment. Monitor, trade, and manage up to 50 stocks as a single entity using basket trading. advanced trading tools and features: explore advanced account features including margin, short selling, and options trading. qualified customers can take advantage of our active trading software to get streaming quotes, directed trading, and more. bond ladders.

Trading prices may not reflect the net asset value of the underlying securities. commission fees typically apply. market volatility, volume, and system availability may delay account access and trade executions. Methodology nerdwallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading. See more videos for trading account.

Purpose of preparing trading account: the profit or loss determined by a trading account is the gross result of the business but not the net result. if so, then a question arises what is the use of preparing a trading account? this account is necessary because of the following advantages. E*trade charges $0 commission for online us-listed stock, etf, and options trades. exclusions may apply and e*trade reserves the right to charge variable commission rates. the standard options contract fee is $0. 65 per contract (or $0. 50 per contract for customers who execute account trading at least 30 stock, etf, and options trades per quarter). A trading account is held by a financial institution and managed by an investment dealer to run a trading strategy for the account holder. there are different types of trading accounts available, including cash accounts and margin accounts. getting started with a trading account. when you open a new trading account you will naturally have a.

Brokerageaccounts come in three different forms: cash accounts, margin accounts, and discretionary accounts. cash accounts -this is the most basic type of brokerage account. Brokerage account: a brokerage account is an arrangement between an investor and a licensed brokerage firm that allows the investor to deposit funds with the firm and place investment orders. A fidelity brokerage account is required for access to research reports. 2. 4. 00% rate available for debit balances over $1,000,000. fidelity's current base margin rate, effective since 03/18/2020, is 7. 075%. system availability and response times may be subject to market conditions. etfs are subject to market account trading fluctuation and the risks of their. A brokerage account is an arrangement between you and a licensed brokerage firm. once your account is set up, you can deposit funds and place investment orders through the brokerage account, and the transactions will be carried out on your behalf.

No comments: